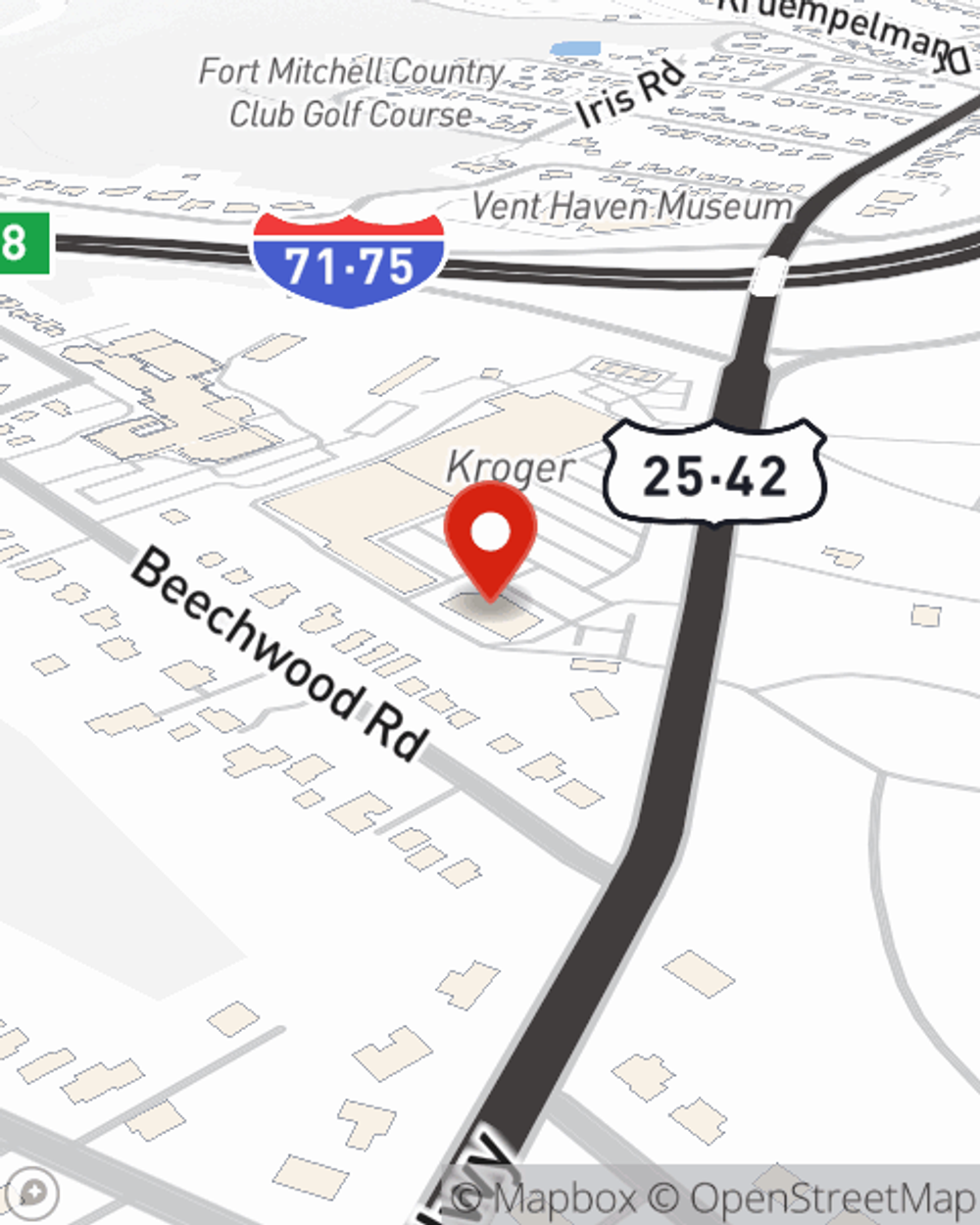

Condo Insurance in and around Fort Mitchell

Fort Mitchell! Look no further for condo insurance

State Farm can help you with condo insurance

- Ft. Mitchell, KY

- Lakeside Park, KY

- Crestview Hills, KY

- Crescent Springs, KY

- Villa Hills, KY

- Bromley, KY

- Latonia, KY

- Covington, KY

- Newport, KY

- Bellevue, KY

- Dayton, KY

- Highland Heights, KY

- Erlanger, KY

- Florence, KY

- Ft. Thomas, KY

- Edgewood, KY

- Alexandria, KY

- Walton, KY

- Crittenden, KY

- Dry Ridge, KY

- Union, KY

- Hebron, KY

- Burlington, KY

- Wilder, KY

Your Personal Property Needs Coverage—and So Does Your Condo.

There is much to consider, like savings options providers, and more, when looking for the right condo insurance. With State Farm, this doesn't have to be a hassle of a decision. Not only is the coverage impressive, but it is also surprisingly well priced. And that's not all! The coverage can help provide protection for your condominium and also your personal property inside, including things like shoes, bedroom sets and cookware.

Fort Mitchell! Look no further for condo insurance

State Farm can help you with condo insurance

State Farm Can Insure Your Condominium, Too

It's no secret that life is full of surprises, which is all the more reason to be prepared for the unexpected with condo unitowners insurance. This can include instances of liability or covered damage to your condo from a tornado, theft or vandalism.

As a dependable provider of condo unitowners insurance in Fort Mitchell, KY, State Farm strives to keep your home protected. Call State Farm agent Michael Cason today for help with all your condominium unitowners insurance needs.

Have More Questions About Condo Unitowners Insurance?

Call Michael at (859) 360-5735 or visit our FAQ page.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Michael Cason

State Farm® Insurance AgentSimple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.